WHOLE LIFE COVERAGE FOR AGES 50-85 - NO MEDICAL EXAM

Same-day decisions and budget-friendly rates from multiple top carriers. Protect your family from unexpected costs and lock in a plan that never expires.

-Immediate coverage available upon approval

-Fixed premiums that never increase

-Benefits that never decrease

-Friendly, licensed help—no pushy sales

GET FREE QUOTE BY FILLING OUT THIS FORM

Meet your Licensed Insurance Agent

Michelle LaShay Williams

YOUR TRUSTED LICENSED

INSURANCE BROKER

Michelle LaShay Williams is an insurance professional with over 25 years of experience specializing in Whole Life Insurance coverage. As a licensed insurance broker in more than ten states, she provides seniors with unbiased plan comparisons, transparent education, and tailored recommendations to protect their health and legacy.

OUR WHOLE LIFE INSURANCE SERVICES

At our agency, we believe that preparing for the future should bring peace of mind—not added worry. That’s why we offer whole life insurance designed to protect families during one of life’s most difficult moments. Losing a loved one is hard enough without the weight of financial stress. Our plans help cover essential costs such as funeral expenses, medical bills, and outstanding debts, so your family can focus on healing and remembrance rather than unexpected expenses

Our mission is simple: to give you and your loved ones the protection, security, and comfort you deserve. With our whole life insurance, you’re not just buying a policy—you’re securing peace of mind for your family’s future.

WHAT SET US APART?

It’s not just about the coverage we offer—it’s about the guidance and support we provide. Our knowledgeable advisors are with you every step of the way, offering clarity, compassion, and professional care. From the moment you begin exploring your options to the day your family may need to use the benefits, we ensure everything is handled with respect, understanding, and a personal touch.

Tailored to your Budget

We provide whole life insurance coverage designed to be affordable for every family, no matter the budget. Planning for the future should bring comfort—not financial stress. That’s why our plans are flexible and created to fit within your means, ensuring your loved ones are protected without added burden. When you choose a plan today, you’re not just securing coverage—you’re giving your family peace of mind, lasting security, and the assurance that they’ll be cared for when it matters most.

Consideration of Health Status

We provide whole life insurance plans that carefully take each client’s unique health situation into account. Coverage should never be one-size-fits-all, which is why we tailor every plan to suit individual medical conditions and personal needs. This approach offers reassurance that your health is respected, and your circumstances are truly understood. With professionalism, care, and a personal touch, we guide you toward the plan that fits best—so you and your family can move forward with confidence, security, and peace of mind.

Flexible Options

We provide whole life insurance coverage designed to adapt to each individual’s unique needs and preferences. Our goal is to empower clients with the freedom to choose a plan that truly fits their circumstances, rather than being forced into a one-size-fits-all solution. With our flexible options, you can select the coverage that works best for you—giving you control, confidence, and peace of mind as you plan ahead for the future.

Compassion and Support

We guide families through final expense planning with genuine compassion and care. We know these decisions can be emotional, which is why our advisors provide not only knowledge and expertise but also empathy and personal attention. With professional guidance every step of the way, our clients feel valued, reassured, and confident in choosing the plan that best protects their loved ones.

Your Agent Is Ready to Help

Get Your Free Quote Today!!!

(478) 744-1922 (Office)

(888)245-0176 (Fax)

Frequently Asked Question

What is Whole Life Insurance and how does it work?

Final Expense Insurance is a type of life insurance designed to cover end-of-life costs such as funeral expenses, medical bills, or outstanding debts. It provides a tax-free lump sum to your beneficiary, ensuring your loved ones aren’t left with a financial burden.

Who can qualify for Whole Life Insurance?

Most people can qualify, even with existing health conditions. Eligibility usually depends on factors like age, health history, and lifestyle, but coverage options are available for a wide range of applicants.

How much coverage do I need?

The amount depends on your goals—many people choose coverage between $5,000–$25,000 to cover funeral costs and related expenses. An agent can help you determine the right amount based on your budget and needs.

OUR SERVICE PROVIDER

We partner with multiple trusted providers to give you a wide range of flexible options that can be tailored to your unique situation. Whether you are looking for an affordable plan that fits comfortably within your budget, or coverage that takes your health status and personal needs into account, we make sure you’re never forced into a one-size-fits-all solution. Instead, you’ll have the freedom and confidence to choose a plan that truly works for you.

Contact Us

[email protected]

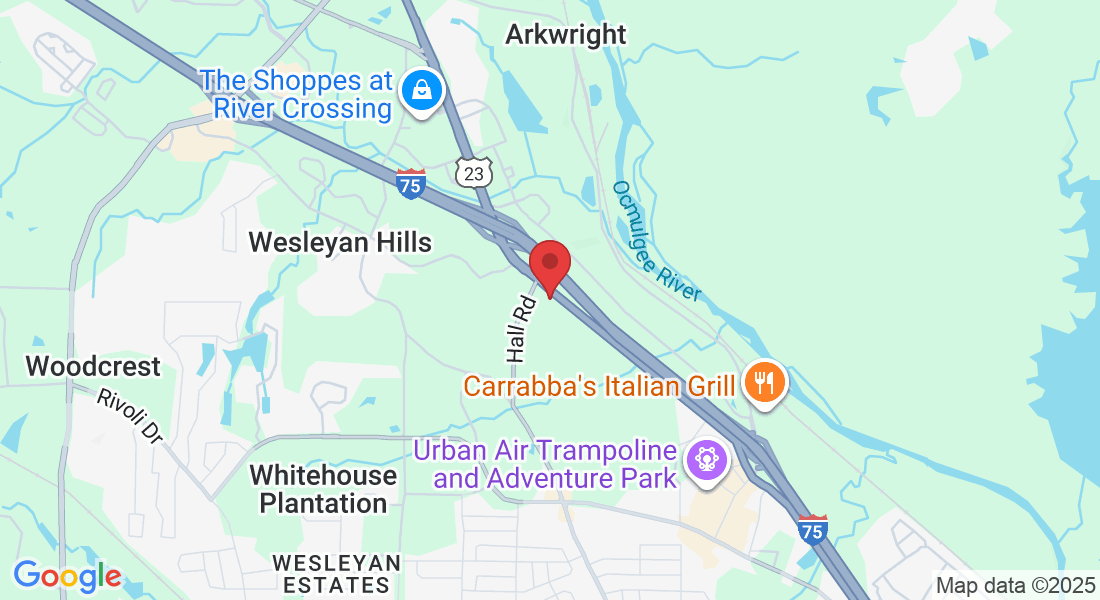

Address

4480 Riverside Dr, Ste 11 Macon, GA 31210

Assistance Hours

Mon – Friday 10:00am – 7:00pm

Saturday and Sunday – CLOSED

Phone Number:

(478) 744-1922

(888)245-0176

Office: 4480 Riverside Dr, Ste 11 Macon, GA 31210

Call : (478) 744-1922

(888)245-0176

Email: [email protected]